ePayment System Market Top Scenario, SWOT Analysis, Business Overview, Forecast 2026

The Emergence of Artificial Intelligence Coupled with Growth in the Software Market is Driving the Growth of the Global ePayment System Market

The global ePayment system market is estimated to be driven by technical advancements in the software industry, and the growth of e-Commerce in developed and developing nations. The adoption of ePayment systems is growing rapidly, and, in the coming future, it will create potential opportunities for ePayment system providers. Consumers across prominent regions such as Western Europe and North America, and some countries in Asia Pacific, are using various digital payment methods.

Furthermore, increasing Internet banking and Internet shopping have significantly pushed the use of ePayment system across the globe. ePayment systems have grown increasingly over the last few decades, due to the spread of Internet technologies. As the world advances more with technology development, it is creating the demand for ePayment systems.

Get Free Sample PDF Copy of Report@ https://www.futuremarketinsights.com/reports/sample/rep-gb-5813

Global ePayment System Market: Competition Analysis

According to FMI analysis, long-term contracts with business partners are likely to increase revenue, and new innovation strategies are estimated to enable ePayment system vendors to reach new growth markets. The global market for ePayment systems is witnessing a trend of mergers and acquisitions, thereby leading towards consolidation of the market.

Key Developments by Vendors in the Global ePayment System Market

- In November 2017, MasterCard provided the Verifone M/Chip Fast technology, enabled with a unique code with tap to pay for all transactions, which will be helpful during peak holiday shopping seasons. In May 2017, the company also entered into a partnership with Zain, to launch mobile wallets in Jordan.

- In December 2017, Worldpay, a global leader in payments, announced that it will partner with Klarna, a leader in invoice and credit-based payments, to further enhance its product portfolio. Worldpay customers trading in Austria, Finland, Germany, the Netherlands, Norway, Sweden, and the United Kingdom, and wishing to accept payments on invoices or instalments, will be able to use Klarna’s invoice and credit-based payments from Worldpay. This will help e-Commerce businesses to improve conversion rates by up to 20%, and provide a fast and smooth checkout process.

- On July 25, 2017, AGTech Holdings Limited entered into a joint venture (JV) agreement with One97 Communications Ltd. AGTech Holdings will hold a 45% stake in the JV, while Paytm will hold the remaining. As part of the agreement, Paytm will invest US$ 8.8 million and AGTech Holdings US$ 7.2 million in the new venture.

Key Segments

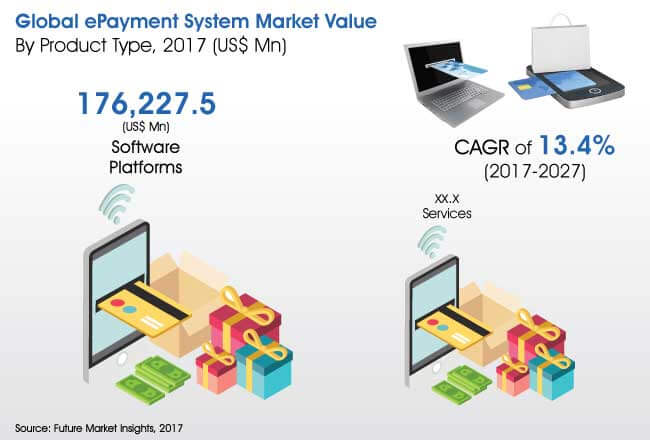

By Product Type

- Software Platforms

- Services

By Payment Mode

- Credit cards

- E-wallets

- Debit & Other Cards

- Bank Transfer

- Cash on Delivery

- Other Modes

Comments

Post a Comment